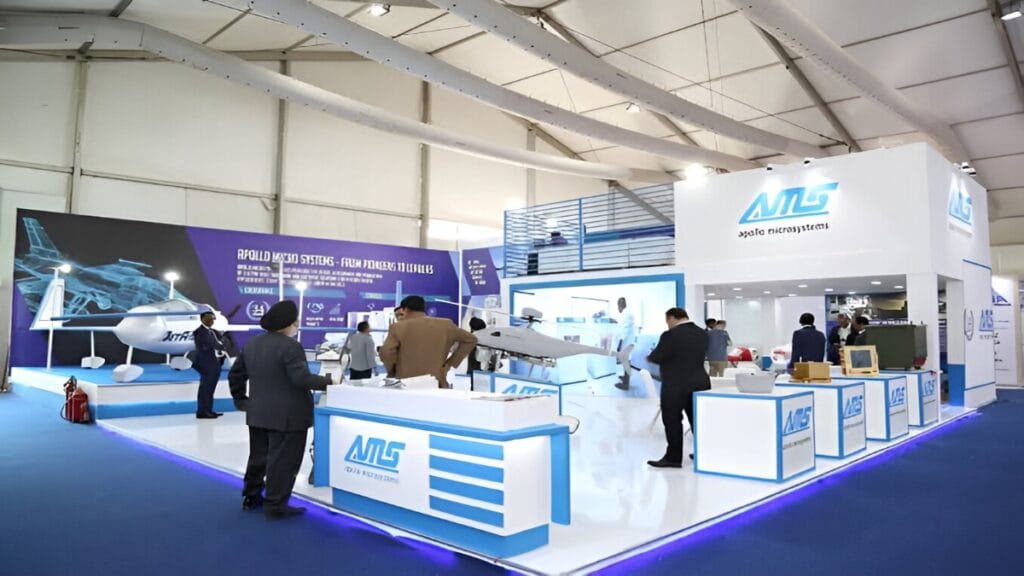

Apollo Miniature Frameworks. An Exhaustive Investigation of Late Turns of events and Future Possibilities Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Apollo Miniature Frameworks Ltd. (AMS), a noticeable player in India’s aviation and guard area, has as of late drawn in huge consideration because of a striking flood in its portion cost. This increment is principally credited to the organization’s hearty request book and a promising pipeline of enormous scope projects. This investigation dives into the variables adding to AMS’s new presentation, its essential drives, and the more extensive ramifications for financial backers and the business.Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Recent Share Performance

As of December 31, 2024, AMS’s portions have encountered a noteworthy increment, coming to ₹117.50 on the BSE, denoting the most significant level since August 2024. Throughout the course of recent days, the stock has flooded by 26%, reflecting elevated financial backer certainty.

Hearty Request Book and Expected Activities

AMS’s ongoing request book remains at roughly ₹550-570 crore, with assumptions for getting extra significant ventures sooner rather than later. Outstandingly, a few expected orders are projected to surpass the organization’s consolidated incomes from the beyond three years, possibly going from ₹1,000 crore to ₹1,500 crore. These improvements are supposed to drive a 100 percent income development in FY26, with an inside focus of 45-half development for the following monetary year.Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Key Extension and Enhancement Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

To satisfy the rising need in the protection and aviation areas, AMS is effectively extending its functional capacities. The organization intends to improve its creation limit by expanding its functional offices to 0.4 million square feet by June 2025. Moreover, interests in innovative work, as well as wanders into arising advancements like RF and microwave frameworks, are in progress. Another weapon joining office is likewise expected to be functional by 2025, further fortifying the organization’s situation as a main Level I Unique Gear Producer (OEM).Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Arrangement with Government Drives

AMS’s development direction lines up with government drives, for example, ‘Make in India’ and the Safeguard Securing Method 2020, situating the organization to profit from India’s push towards confidence in guard fabricating. Cooperation in native rocket programs close by substances like the Guard Innovative work Association (DRDO) highlights AMS’s necessary job in propelling the country’s protection abilities.Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Ongoing Agreement Acquisitions

On December 24, 2024, AMS reported that it had gotten a critical request esteemed at ₹6.14 crore from DRDO. This request features the organization’s ability to convey uniquely assembled hardware and electro-mechanical frameworks custom fitted to the requirements of the safeguard area. Such coordinated efforts with DRDO empower organizations like AMS to take part in state of the art tasks and upgrade their specialized mastery.

Monetary Execution and Market Measurements

In the beyond five days, AMS’s portion cost has energized 17%, and throughout the past month, it has expanded by 8.1%. In any case, in 2024, the offer cost has seen a downfall of 8.6%. The stock contacted its 52-week high of ₹147.5 on February 27, 2024, and a 52-week low of ₹88.1 on October 23, 2024.

Financial backer Feeling and Market Standpoint

The new flood in share cost reflects elevated financial backer trust in AMS’s essential heading and development possibilities. The organization’s capacity to get high-esteem projects and its obligation to extending creation capacities recommend an uplifting perspective for supported development before long.Apollo Micro Systems Shares Jump On Strong Order Book, Big-Ticket Projects In Pipeline

Conclusion

Apollo Miniature Frameworks Ltd. remains at a vital crossroads, with a vigorous request book and key drives lining up with public safeguard goals. The organization’s new agreement acquisitions, development plans, and arrangement with government drives position it well for supported development. Financial backers and industry partners will acutely notice AMS’s execution of these activities and its capacity to explore the unique aviation and guard scene.

For a more top to bottom investigation of the elements adding to Apollo Miniature Frameworks’ portion cost increment, you might find the accompanying video clever: